Excise & Taxation slap Rs one Crore penalty for diesel smuggling

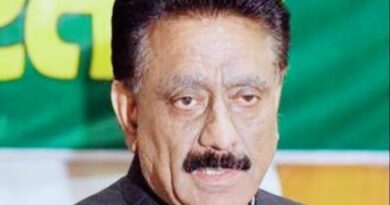

Himachal Pradesh Excise and Taxation bust a diesel smuggling from Himachal Pradesh to Haryana as account of a petrol pump for verified selling diesel without payment of Central sales taxes. State Excise and Taxation Commissioner Yunus told us that during inspection of documents at Manpur near industrial area Baddi. State Excise and Taxation officers found evasion of Sale Tax which was surfaced after verification of documents of this petrol pump. Noe ET Department issued a notice to deposit pay tax and fine of Rs one crore. This smuggling of diesel was allegedly supplied in oil tankers from this petrol pump in Baddi. He said that preliminary investigation found that l Diesel worth nine crores was smuggled from the same petrol pump and sold in Haryana and Jharkhand from last April till now. Despite cheaper price of diesel in Haryana the smugglers design a unique method and diesel worth nine crores went to the outside states from the petrol pump. The department had took this action after receiving an intelligence input. Now Department slapped a notice to owner of petrol pump to immediately asked to deposit one crore rupees as penalty and evasion of Central Sales Tax within fifteen days. It is worthwhile to mention here that despite strict vigil during Election code and conduct alleged tankers gave slip to Excise barrier staff. According to the rules, no tanker could be filled from petrol pumps and taken to outside states. This is sheer violation of the rules. But all this went on unabated under the nose of former Jairam Sarkar. Now it cane forth that fake bills were issued to carry out smuggling. According to Yunas filling of tankers is allowed only after the approval of Indian Oil Corporation for factories and big construction works. These tankers are less than three thousand liters. And for this there is a separate arrangement of gentry at the petrol pumps. However tankers of 12 thousand liters kept roaming on the interstate border roads openly.