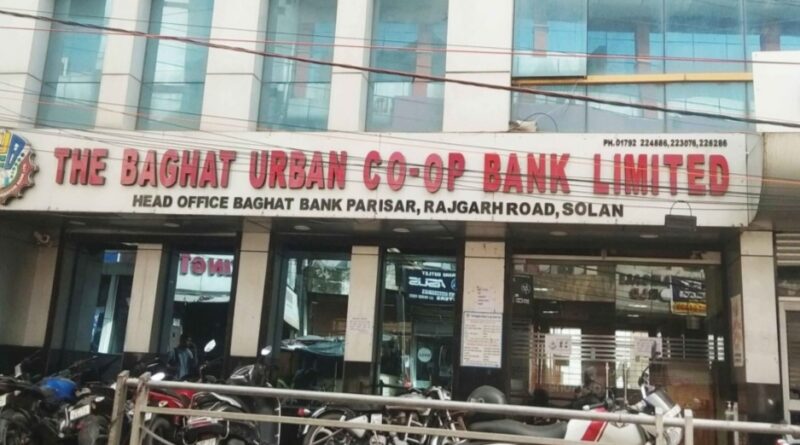

Baghat Bank Offers Relief to Loan Defaulters, Hope Rises for 77,000 Account Holders

In a significant move to ease financial stress, Baghat Bank has rolled out a one-time settlement policy designed to help loan defaulters clear their dues. Under the scheme, borrowers will enjoy concessions on interest payments, though the full principal must still be repaid. The initiative, recently approved after recommendations from the Assistant Registrar’s office, is being seen as a lifeline for many struggling customers.

Bank Chairman Arun Sharma explained that the decision will make repayment “easier and cheaper” for those who have long been unable to settle their loans. Early signs of improvement are already visible — the bank’s Non-Performing Assets (NPAs) have dropped from 138 to 129, signaling progress in recovery efforts.

The Reserve Bank of India had earlier imposed strict restrictions on Baghat Bank due to rising NPAs and irregularities. Since then, notices have been issued to borrowers, and several cases have been resolved through the Registrar’s court. Senior bank officials have also met with Chief Minister Sukhvinder Singh Sukhu and Deputy Chief Minister Mukesh Agnihotri to update them on recovery progress, while discussions continue with the State Cooperative Bank.

For now, however, account tapping remains in place — meaning customers cannot withdraw more than ₹10,000. This restriction has left over 77,000 account holders frustrated, with their money stuck. Many are now pinning their hopes on the improved recovery process, believing it could soon persuade the RBI to ease restrictions and restore normal banking operations.

The new settlement policy is more than just a financial measure; it represents a chance for Baghat Bank to rebuild trust and stability, while offering long-awaited relief to its customers.