Himachal’s Devolution Under FC-16 Increased by Approximately ₹2,388 Cr : Anurag

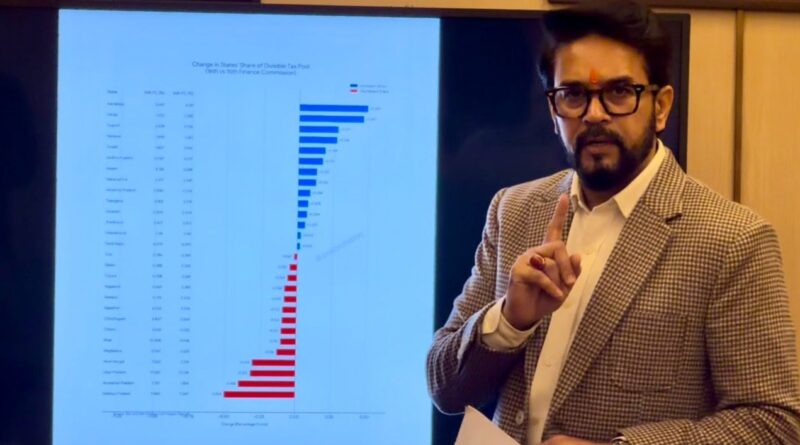

Himachal Pradesh: Former Union Minister and MP from Hamirpur, Shri Anurag Singh Thakur, today shared a detailed fact-based presentation regarding the comments made by the Chief Minister of Himachal Pradesh on the discontinuation of the Revenue Deficit Grant (RDG) by the Sixteenth Finance Commission (FC-16). Shri Thakur’s presentation is based on the data of the 16th Finance Commission and the analysis presented in the Commission’s report, which clarifies the entire situation regarding the Revenue Deficit Grant in Himachal Pradesh.

Shri Anurag Singh Thakur said, “Under the leadership of Hon’ble Prime Minister Shri Narendra Modi ji, the Central Government has always paid special attention to the interests of Himachal and never allowed any shortfall. It is unfortunate that the Congress government is misleading the state on the Revenue Deficit Grant (RDG). I appeal to the Congress government of Himachal not to blame the Centre for its financial mismanagement. I would like to clarify with data that Himachal’s share has actually increased under the new formula. Before that, I would like to state that the Revenue Deficit Grant was not a permanent but a temporary arrangement, and the 16th Finance Commission did not recommend a general RDG because several recipient states, including Himachal, consistently showed a pattern of weak tax effort and high committed expenditure.”

Shri Anurag Singh Thakur said, “Himachal’s devolution has not decreased but increased. Contrary to Congress’s hollow claims of ‘unjustified cuts,’ the 16th Finance Commission has increased Himachal Pradesh’s share in the divisible pool from 0.830% under the 15th Finance Commission to 0.914%. Under the new formula, Himachal’s post-devolution receipts have increased from approximately ₹11,561.66 crore in the 2025-26 Budget Estimates (BE) to ₹13,949.97 crore, which is an increase of about ₹2,388 crore. This is a significant increase in central tax devolution. Under the 15th Finance Commission, the RDG was front-loaded to help states recover from COVID and was explicitly designed as a time-bound, transitional measure aimed at bringing states to near-zero revenue deficit by 2025-26. The 16th Finance Commission reviewed the outcomes and concluded that despite large RDG transfers under the 14th and 15th Finance Commissions, the actual revenue deficit did not move towards normalization because many states did not strengthen revenue collection or rationalize expenditure. Therefore, the 16th Finance Commission deemed it inadvisable to continue the general RDG, as it could create distorted incentives and reduce pressure for structural reforms.”

Shri Anurag Singh Thakur stated that the Modi government does not discriminate against states. Several opposition-ruled states have also benefited in devolution under the 16th Finance Commission formula. The horizontal redistribution initiated by the 16th Finance Commission involved re-weighting criteria, increasing the weight on population/demographic performance and adding a 10% weightage for contribution to GDP, while reducing the weight on area. This benefited many states, including several opposition-ruled states, while some others saw a reduction. Therefore, the 16th Finance Commission’s adjustments cannot be portrayed as a partisan practice.”

Comparing Himachal Pradesh with Uttarakhand, Shri Anurag Thakur explained that these same criteria influenced the Commission’s decision.

- Low Own-Tax Effort: Himachal’s own tax revenue in 2023-24 was about 5.6% of GSDP, while Uttarakhand’s own tax effort was about 6.1%. This gap is significant as higher tax effort reduces dependence on central transfers.

- High Revenue Expenditure (and Low Fiscal Space): Himachal’s total revenue expenditure was about 21.0% of GSDP, while Uttarakhand’s was ≈15.0%, indicating that Himachal has higher recurring commitments that limit development expenditure.

- High Fiscal and Revenue Deficit: Himachal recorded a fiscal deficit of ≈5.3% of GSDP and a revenue deficit of ≈2.6% in 2023-24, while Uttarakhand had a fiscal deficit of ≈2.5% and a revenue surplus of ≈1.1%. Persistent revenue deficit is precisely the problem RDGs were created to eliminate, not to perpetuate.

- Heavy Liabilities (Debt Burden): Himachal’s outstanding liabilities in 2023-24 were about 42.8% of GSDP, while Uttarakhand’s were ≈25.5%. High debt increases interest payments and reduces fiscal flexibility.

- Low Capital Expenditure Push: Data shows that Himachal’s share of capital expenditure (capex) in total expenditure is relatively low compared to other states, indicating that a larger portion of the budget is consumed by revenue expenditure and debt servicing, not productive investment.

These criteria are the reason why the 16th Finance Commission decided that continuing the general RDG, which masks structural financial weaknesses, is not an appropriate policy solution.

Shri Anurag Singh Thakur emphasized that the Commission’s recommendations are based on these measurable financial realities, not on partisan considerations or Congress’s baseless rhetoric.

Shri Anurag Singh Thakur described the journey of RDG in Finance Commissions. Earlier Finance Commissions (like FC-12/FC-13) had limited RDG to special category states. FC-14 reinstated large RDGs as many states slipped back into deficit. FC-15 provided post-COVID front-loaded bridge grants with the explicit aim of bringing revenue deficit near zero by 2025-26. According to FC-16’s assessment, RDGs had become recurrent rather than corrective transfers. Therefore, it decided to discontinue regular RDG and instead recommended support through targeted instruments and enhanced devolution as needed. These historical facts show that FC-16’s step is the completion of an established policy cycle, moving from temporary relief to reform-oriented, conditional transfers.”

Shri Anurag Singh Thakur concluded his remarks with a direct appeal to the people of Himachal Pradesh: “The people of Himachal Pradesh should not be misled by Congress’s hollow claims. The Commission’s data shows that Himachal’s devolution under FC-16 has increased by approximately ₹2,388 crore. The challenge we face is not about who is taking what from whom, but about how to restore fiscal discipline, improve tax effort, and invest in our future. This is the path to lasting prosperity for Himachal.”